Property prices set to continue to soar

Property prices in Portugal, driven by demand, are set to continue to soar according to the ‘Portugal’s Property Hotspots Report 2023-2025’ from the Property Market Index.

The reason? Demand and prices continue to benefit from the triple-whammy of international, urban regeneration and tax incentives for affluent expats, although the Non-Habitual Residents (NHR) tax regime that offers generous tax breaks and incentives for 10 years, will now end from next year.

The findings come in a new study by Property Market Index, an international real estate research company. In its report ‘Portugal’s Property Hotspots 2023-25’ concludes that all the signs are that Portugal’s property market will continue to exceed expectations.

The findings were discussed at a real estate webinar organised by Portugal Pathways last week that also looked at trends for the next three to five years and found that despite the scrapping of the Golden Visa and Non-Habitual Residents programmes, demand and interest from overseas citizens are set to remain high.

Some of the findings of the ‘Portugal’s Property Hotspots Report 2023-2025’ found that Portugal had seen a 6.5% growth in property prices over the past 12 months with real estate in the Algarve in prime locations up 15%.

In terms of areas of demand in Portugal; Lisbon, Cascais, Estoril, and Sintra continue to be popular, while values in these areas and along the Silver Coast, Porto and Braga in the North have surged in value, with these property hotspots expected to increase by 8.7% in 2024.

In the Algarve, Quinta do Lago, Vale do Lobo and Benagil continue strong in terms of demand for properties. In and around Lisbon, Comporta, Sintra, Cascais and Estoril have outperformed the overall market, not just in Portugal but internationally.

High demand drives new developments

The report also reveals that there is indeed a lack of new build housing and second-hand housing on the market. For every 10 houses sold, only one is built, driving high demand for new developments.

However, the idea that overseas property buyers are driving up prices, artificially inflating the housing market at the risk of creating a property bubble, does not stand up to scrutiny given that foreign residents comprise only 7% of Portugal’s population.

Amanda Collison at Property Market-Index said: “Contrary to predictions in some quarters, our latest research report into Portugal’s property market shows that the market remains vibrant, and investors are bullish about prospects for the next three to five years.

“Interest from wealthy expats from across the globe continues to increase, particularly from the US, UK, South Africa, Brazil, Asia, and Canada. This is mainly due to the appealing visa and Non-Habitual Residence (NHR) tax regime opportunities, and potential political and economic challenges in other countries.

“From the onset of 2023, a significant increase in investments from affluent international investors and relocators has been recorded in Portugal. As we go into the third quarter of 2023, Portugal has already surpassed the total assets in real estate in the previous year.”

She adds: “The biggest draw for Portugal is the culture, heritage, weather, quality of life, and the incentives for investors and wealthy expats looking to take advantage of the visa and tax programmes.

“The Algarve region has seen a 15.3% growth in property prices in the last year, making it the second highest-performing market across Europe,” she said.

A safe haven and rich cultural experience

Anne Brightman CEO and Founder of Brightman Group, a leading boutique real estate agency in Portugal based in Estoril, commented on these latest findings: ‘’When I moved here myself some years ago from Brazil via the US, it felt so safe and secure, and has become such a rich cultural experience.’’

‘’We have seen continued upward momentum in the luxury end of the real estate market in and around Lisbon, as well as the Algarve. Investment in regeneration and quality developments continue to make Portugal such an attractive place to invest in property,’’ she said.

The webinar was hosted by leading international platform Portugal Pathways, which has offices in Lisbon, the Algarve, New York, and the UK. It specialises in Portuguese visa, tax and investment options and how best to capitalise on the country’s enticing tax schemes for expats.

Steve Philp the webinar host and Director of Portugal Pathways said: “We are delighted to have hosted the launch of Property Market-Index’s report on Portugal’s thriving real estate market.

“It confirms that with available properties and new developments limited, prices are set to only to increase.

“While the Golden Visa scheme is under consideration, there are still a number of ways to capitalise on Portugal’s enticing way of life and tax schemes available for affluent expats.

“Among them, the Non-Habitual Residence (NHR) tax regime which offers 0% tax on non-Portugal derived passive income such as dividends, royalties, and certain rental income — and just 10% on pensions for those domiciled in the country”. However, within one day of the webinar, the Portuguese Prime Minister, António Costa announced the scheme would end at some time next year, meaning NHR eligible citizens need to act fast if they want to still take advantage of the tax benefits.

Even so, for wealthy people’s succession planning, Portugal also has advantageous inheritance rules compared, for example, with the UK.

Olivia Wingrove, Portfolio Manger at LGT Wealth Management concurred that certainly they were doing a lot more work out of Portugal with a lot of financial advice and more clients because of its unique characteristics and favourable tax benefits.

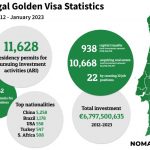

Golden Visa no longer the driving force

Paul Stannard, Non-Executive Chairman of the Property Market Index on the impact of the Golden Visa programme on the Portuguese property market for the coming year said: “The Golden Visa is now no longer the main driver since it is under review.

“It has been very much the NHR scheme that has had the biggest impact. In terms of all the visas available (Both the D7 and the D2 will get relocaters a residence and work permit. The difference is that if they come to Portugal with, for example, a job offer in Portugal, or the clear goal to set up a company, they would have to go for the D2. If relocaters, such as pensioners or retirees solely have a passive income, these would have to go for the D7). “It seems that Portugal is becoming more and more attractive, and people are not just moving for the visas and tax reasons; it’s more about lifestyle and security, the culture, gastronomy and climate, with Portugal ranked as the No1 country for retirement according to a report this month from www.movingtospain.com, followed by Spain and then Italy.

Spread your risks

However, Paul advised it was very important to distribute investment over different asset classes in order to spread risk, although the Portuguese property market was stable and offered good returns of 5% across the asset class, making it a low risk.

“It’s really up to the individual client’s objectives and investment time line. However, after many years working in asset management and investments the old adage ‘if it looks too good to be true, it generally is’ still stands,” he warned.

David Vacani, Chairman of Federation European Independent Financial Advisors (FEIFA) and CEO and Founder of BG Wealth Management, said: “Certainly the Portuguese property market is very stable and we always say that you shouldn’t just move for tax purposes, you’ve got to enjoy your lifestyle and the things you like, but 300+ days of sunshine goes a long way”.

“And we are seeing an increasing number of US citizens moving to Portugal and finding residences here”, he added.

In terms of the share of British and American ex-pats investing in Portuguese property over the past year, the US, Canada and UK are continuing to lead the way despite the challenges of high interest rates and Brexit (in the case of UK investors), while Brazil with its links to Portugal is also very strong.

But how will the market perform over the next three years? David Vacani says that because of the lack of supply and high demand in Portugal, prices will remain high, although there are a lot of new developments in the pipeline, while demand will, he predicts, remain strong.

Regeneration and multigenerational developments

Anne Brightman, CEO of the Brightman Group Luxury and Investment Real Estate said there was a lot of regeneration and new developments in the Cascais Estoril area, and particularly in the Algarve,

“We’re seeing multi-generational developments on which construction has already begun. There are commercial and residential mixed-use developments, and we see that trend throughout Portugal, particularly in the Algarve, but also in Porto and the North too. Braga is an area that is booming right now”, she said.

However, Anne Brightman added that with these developments it takes three to five years on average to get planning permission permits to begin construction, so the backlog in the municipal councils has created a shortage in the inventory for the time being, which affects pricing.

The luxury Estoril boutique realtor said that they had structural regeneration projects in the pipeline. “We have one that will be getting pre-sales from the end of November. The project is created around a Swiss anti-aging, longevity and wellness clinic that will be built around this multi-generational project. The project is close to Lisbon. “I think this is going to be a benchmark development in that type of property because it will have a golf course, padel courts, and tennis courts. Portugal is very well positioned to advance with this type of clinic/residential development”, she explained.

Steve Philp the webinar host and Director of Portugal Pathways concluded by saying: “We are delighted to have hosted the launch of Property Market-Index’s report on Portugal’s thriving real estate market.

“It confirms that with available properties and new developments limited, prices are set to only to increase”.

About the speakers:

Paul Stannard: Chairman of VIF Fund for investment in Healthtech & Enabling Technologies. Chairman of World Nano Foundation & World Science.

Steve Philp: Part of an expert team at Portugal Pathways with experience in navigating Portugal’s visa & Non Habitual Residency (NHR) tax systems. It uses its experience to enhance wealth & tax benefits for affluent expat clients,supporting thousands of expats with their visa and tax positions, deploying a unique financial model to optimise their finances, non-Portugal derived income, pensions, investments, and life in Portugal.

Anne Brightman: Founder and CEO of the Brightman Group that specialises in all aspects of residential and commercial real estate, including property evaluations, inspections, and restorations.

Olivia Wingrove: Portfolio Manger at LGT Wealth Management.

David Vacani: CEO and Founder of Beacon Global Wealth Management and Chairman of Federation of European Independent Financial Advisors (FEIFA), the body that works to support policy on behalf of IFAs in Europe.